Oh, come on! Barclays Capital is now cutting its price forecasts for metals AFTER the 20%-or-so decline in gold, copper and other metals -- just as metals seem to be finding their footing!

Barclays blames it on the rates -- they expect the US Federal Reserve to increase rates to 6% this year, from a previous forecast of 5.5%.

"In light of this revision, we expect the recent patternof sideways and highly volatile trading to continue for most ofthe third quarter and so have revised down our average price forecasts for base metals,'' Barclays analysts led by KevinNorrish said in a report dated June 26.

Now here's something interesting: For the year, Barclays cut its average estimate for copper to $6,876 a ton, 6% lower than its earlier projection of $7,300. The metal has averaged $6,047 a ton this year. So while Barclays is revising its price forecasts LOWER, those prices are still higher than where metal is now.

Barclays is also less positive on gold, thanks once again to rising interest rates.

But you know what? 16 interest rate hikes haven't slowed the global economy. What makes Barclays think raising interest rates to 6% will do the trick?

If anything, the US economy is STRONGER than expected. Housing may be slowing down. But in May, U.S. home sales defied predictions of a slowdown and actually rose 4.6%.

And look at durable goods orders. They fell 0.3% last month -- but if you look below the headlines, you’ll see the real news. Most of that drop was due to aircraft orders, which are always volatile. On the other hand …

- Orders for autos and auto parts rose 2.5% in May.

- Orders excluding transportation equipment rose 0.7%.

- Non-defense capital goods orders were up 1% -- a nice reversal of the 1.9% drop the previous month.

- More importantly for the stocks in Red-Hot Asian Tigers, orders for primary metals rose by 3.5%. That’s HUGE!

The U.S. economy surged at an annual rate of 5.3% in the first quarter, and it’s hard to keep up that pace. Could there be soft spots? Absolutely. But the trend still looks up, both here and overseas.

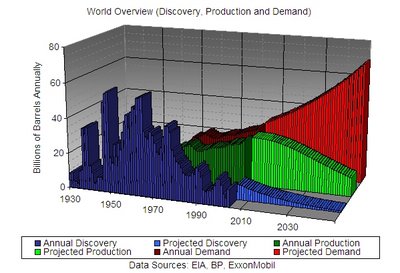

Speaking of overseas, China's fixed-asset investment -- things like power grids and other metal-intensive projects -- rose 31.3% in the first five months of the year compared to a year earlier.

Here's a funny story. China’s steel mills buy 44% of all iron ore that is traded internationally. Last year, they agreed to pay 71.5% more for iron ore. This year, they vowed to negotiate a lower price with companies including BHP and Rio Tinto. China’s biggest producer, Baosteel, represented the industry at the negotiations. The negotiations dragged on for weeks … then months.

Finally, Baosteel and China agreed to a 19% price hike, bringing them in line with what the Europeans and Koreans have already agreed to.

Interestingly, Zou Jian, chairman of the Metallurgical Mines Enterprise Association of China, has vowed to wreak “revenge” on the miners. What kind of revenge might that be? According to press reports, China will pursue ownership of Australian mines to better lock in supply.

Gee, I can think of a few underpriced miners who would probably benefit from that courtship. And that makes the market even more interesting.

And as for India -- it is just starting -- STARTING -- a massive investment wave into roads and infrastructure. Meanwhile, personal income is growing at a double-digit rate in India, and 24 MILLION Indian households will be able to afford a car for the first time in the next two years.

By golly, I think that's going to require a lot of metal.

So, Barclays lowers its price forecast. Big whoop!