Oh, Discordia! I wrote a long ... perhaps too long ... Money and Markets for Wednesday. It was cut WA-A-A-A-AY down.

I could accept this, much as Hero of Alexandria accepted that the Roman authorities kept nixing his inventions (for fear they would be used to topple the state). Or...I could print it right here on my blog.

Who is Hero of Alexandria? Well, to find that out, read the director's cut of ...

How to tell the Saudis to Kiss Our ButtsLast week’s terrorism news hides an elephant in the room: Everyone applauds the arrest of the two dozen terror suspects who plotted to blow British airplanes out of the sky ... and they cheer as banks freeze their private accounts ... but they ignore the fact that much of al Qaeda’s money comes from Saudi Arabia. While the Saudi government is very active in fighting terrorism, on the other hand, Saudi money supports the spread of the radical version of Islam espoused by Osama bin Laden … and there’s also direct Saudi financing of terrorists. Earlier this month, the Treasury Department said it would freeze assets belonging to Abd Al Hamid Sulaiman Al Mujil, a Saudi national. Reason: Al Mujil provided financial support to the Al Qaida terror network.

The sad fact is Americans are funding al Qaida every time we fill up our gas tanks. That gasoline is made from oil, and some Saudi oil revenues are siphoned off to Islamic radicals. Saudi Arabia will earn more than $203 billion in oil export earnings this year, an all-time record, up 25% from the record last year of $162 billion. How much of that do you think is going to support the spread of radical Islam?

So why doesn’t our government take the Saudis to task? It’s hard for an addict to come down hard on a major enabler of his addiction. And as President Bush himself has said, America is addicted to oil.

Maybe It’s Time to Beat Our Addiction

How are we going to do that? Before I tackle that question, let’s go back to the invention of the steam engine. It sounds like one heck of a side trip, but trust me, it could be very profitable for you.

Now when you ask most people who invented the steam engine, they might say: “the first steam engine was patented by James Watt, a Scottish inventor, in 1769.” If they’re feeling really clever, they might say “Thomas Savery invented a steam pump for use in mining in 1698 – that was the first steam engine.”

And they’d be wrong.

The first steam engine was invented in Roman times -- shortly after the birth of Christ -- by a guy named Hero of Alexandria. Hero was, as we say here in Florida, “a frickin’ genius,” the Michelangelo of his day. He was nicknamed “Michanikos – The Machine Man.” So why haven’t you heard of him? Because many of Hero’s inventions had military applications, so he was kept something of a state secret. For example, Hero invented …

birth of Christ -- by a guy named Hero of Alexandria. Hero was, as we say here in Florida, “a frickin’ genius,” the Michelangelo of his day. He was nicknamed “Michanikos – The Machine Man.” So why haven’t you heard of him? Because many of Hero’s inventions had military applications, so he was kept something of a state secret. For example, Hero invented …

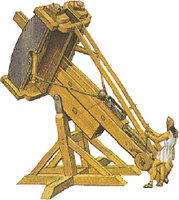

- The “Cheirobalistra,” a device that hurled large arrows over long distances.

- The “Palintonon stone-thrower,” which did the same thing, only with rocks or iron balls. Hero wasn’t the first to do this (that honor belongs to Archimedes), but his threw bigger rocks further distances.

- A surveying device that used triangulation – about six centuries before the English reinvented it.

Each one has military applications. The Roman authorities recognized that such things could be used against them. After all, Archimedes’ catapult was first used to rain rocks down on Roman ships. So, they clamped down on Hero’s inventions one after another, sending him back to the Great Library of Alexandria in frustration.

Hero Goes Hollywood!

So, Hero did what any frustrated genius might do – he went Hollywood. He started churning out inventions that added “ooh” and “ahh” to theater and religious events. Gizmos like a machine that produced thunder on cue, and a device that automatically opened a temple door when a fire was lit on an altar.

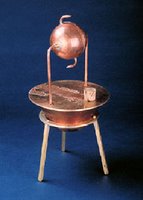

And one of his devices was, as Hero called it, an Aeolipile (Wind Ball). It generated steam and turned it into rotary motion, which is what steam engines do.

By this time, Hero was in his full-blown theater phase, so the Aeolipile was left as an amusement and nothing else. Imagine what the Romans could have done with railroads. After all, the Greeks invented rails around 600 BC. You don’t have to be Pythagorus to add up the possibilities.

If Hero’s steam engine was put on rails and attached to a cart, why, you’d have a “steam carriage.” We’d have to come up with a new word for that: “Locomotive,” maybe. Hmm… Veni, Vidi, Wheeeeee!

And if the Romans had developed the locomotive, imagine where we’d be today. I think we’d be colonizing space … and speaking Latin. I had two years of Latin in high school. My grades suffered toward the end as the grammar got more complex. “Damn you, future pluperfect tense, damn you all to hell!”

Sorry, I was having a high school flash-back there. Now, let’s flash forward to today.

The End of the Oil Age

The sad truth is the world is running out of oil. I’ve given you some good reasons why that is happening. But it all boils down to simple supply and demand.

- The world used 31 billion barrels of oil in 2005. That’s the most oil used in a year … EVER.

- And yet, despite the highest oil prices in decades, despite the fact that every rig that could be hauled out of storage was put to use, less than 9 billion barrels of oil were discovered last year. That means we’re using up 3.4 barrels for every 1 we find.

- It’s going to get worse. Global oil demand is expected to grow by 1.2 million barrels per day (mb/d) this year to 84.8 mb/d and grow again next year by another 1.6 mb/d, according to the International Energy Agency.

We’re going to have to find something besides conventional, ol’ reliable oil to rely on in the near future. What comes next?

Time to be a Hero!

Would you believe steam?I’m not recommending you run out and buy a classic steam locomotive – though it would look awfully cool in your driveway.

Instead, one of the many uses of a steam engine is nuclear power. A nuclear reactor does not directly generate electricity. The reactor sits there and gets hot, which heats up water, creating … steam. That turns a turbine, and away we go!

And here’s where we get to the profit part of this article.Did you know…

- Demand for uranium is far outstripping present supply. Production from world uranium mines now supplies only 62% of the requirements of power utilities.

- About a third of annual demand for uranium was met by Russia’s highly-enriched uranium weapons de-commissioning. We are fast reaching the end-game on that. Inventories are declining FAST.

- Until recently, no new mines were built outside Canada for 20 years.

No wonder uranium prices are up 61% in the last year alone! Boy, with prices rising like that, utilities must be thinking twice about building nuclear power plants, right? Nope. There are 442 nuclear reactors in operation, 28 under construction, 38 planned and 115 proposed! That’s a lot of growth in demand.

Why? Because nuclear energy is still cheap compared to the alternatives. For example Westinghouse claims its Advanced PWR reactor, the AP1000, will be able to generate electricity at 3.3 cents per kilowatt-hour, including construction of the plant. That’s a bit more expensive than coal, but less expensive than natural gas. Unlike coal, nuclear power doesn’t generate greenhouse gases. With the world getting warmer, we need to figure that in, too. And the next generation of nuclear power plants will be much safer and substantially faster to construct.

While there is a short-term supply/demand squeeze in uranium, it’s only in the shorter term. Uranium isn’t rare. It’s as common as zinc. And there is plenty of exploration going on – enough to raise the proven amount of uranium resources to 85 years supply at current consumption rates. We can’t say the same about oil.I expect we’ll use uranium a lot more. In fact, I expect we’ll see a rush into uranium that’s the equal of any gold rush. That is – we will if we’re smart.

Here’s What Could Go Wrong

But what if we make the Roman mistake … and don’t use nuclear power? Could that happen? The anti-nuke movement in the US is pretty subdued for now, with the memories of 3-Mile Island fading into the background. But there is a worsening problem that could wake it up … and turn the US off of nuclear power. That problem is the Hanford Nuclear Reservation in Washington state – the most polluted site in North America. Nearly two-thirds of America’s nuclear-weapons waste is stored at Hanford, most of it in 177 underground tanks that are decades old. A million gallons of nuclear waste is already seeping from tanks at Hanford to form an underground plume that is inching toward the Columbia River. If it reaches the river, it will poison it for hundreds of years.

Consider that: The Columbia River and everything along its banks is in danger of being poisoned for centuries. If al Qaida was doing this, would we stand for it?But al Qaida is not involved, so the Bush administration’s attention is focused elsewhere. Plans to clean up Hanford have run afoul of mismanagement and the fact that the waste-treatment facility being built at Hanford was not designed for earthquakes. Hanford is in an earthquake zone. The Government Accountability Office, the Nuclear Regulatory Commission and the Army Corps of Engineers have all raised alarms about Hanford. In April, The Government Accountability Project (GAP), a government watchdog, issued a scathing report on Hanford, the Department of Energy and Bechtel, which is building the waste-treatment facility.

Say Hello to the Dark Ages

If the nuclear poison reaches the river, atomic energy is going to come front and center – in a very bad way – for the US. That could turn out the lights on the US nuclear program … and as conventional energy resources become more and more expensive, usher in a new dark age for the US.

Remember the Romans had plenty of advances that were lost for generations. They discovered geometry … mechanical clocks … concrete that set underwater … even advanced medicine such as cataract removal. All of it was lost in the dark ages. Again, I wonder what would have happened had the Romans used the power of steam to revitalize their civilization. Seizing opportunities leads to more opportunities.

On the bright side, I think the US will correct and get past the blunders at Hanford. Nuclear power gives us more than just the ability to keep the lights on. We can start electrifying the railroads, like the Chinese and Russians are already doing. We can build electrified mass transit. We can build electric cars. In short, with enough nuclear power, we can tell the terrorist-funding Saudis to kiss our collective buttocks.

Nuclear Is One Alternative … and The Best Alternative

Are there other alternatives? Yes! Solar, wind and biomass all have their place; they just aren’t as far along the road as nuclear power. I think nuclear power is our bridge to the future. After all, it uses steam engines, which as I’ve shown you, were invented in Roman times. Two thousand years is plenty of time to work out the kinks.

In fact, I’m so bullish on nuclear power, I’ve already got two uranium plays in my Red-Hot Canadian Small-Caps portfolio and I’m adding a third today.

I’ll tell you about that in a minute. Maybe individual stocks aren’t for you. In that case, consider these exchange-traded funds…

#1) The Safe Route – The XLE

Oil prices are going to trek higher for years to come – alternatives including nuclear aren’t even close to filling the gap. That makes the Energy Select SPDR (XLE) a safe bet. It owns Exxon Mobil, Chevron and others. Are they profitable? Heck, yeah! Five of the world's largest oil companies -- BP as well as Chevron Corp., ConocoPhillips, Exxon Mobil Corp. and Royal Dutch Shell PLC -- reported combined earnings in the second quarter of $34.6 billion, up 36% from a year earlier.

#2) More Risk and Potential Reward – the PBW.

If you have a higher tolerance for risk, consider the Powershares WilderHill Clean Energy (PBW). This fund invests in companies that are concentrating on highly experimental technology. They should benefit from higher oil prices, government subsidies and a rush of investor money into alternative energy as oil prices go higher. In fact, venture capitalists invested a whopping $843 million in alternative energy and other clean technologies in the second quarter – a 64% gain.

PBW is a volatile fund – down 28% from its highs earlier this year – but it could really pay off. It has a total expense ratio of 0.7%.

But to really make the most of the coming wave, you need to buy small-cap companies, especially small-cap uranium companies. Companies like…

My Latest Pick Is a White-Hot Uranium Explorer

This gold and uranium explorer has potentially rich properties ranging from the hills of Asia to the wilds of Canada. It’s already making money, trades at a much lower price-to-book value than the industry average, and has very little debt and plenty of cash in the bank. More importantly, it has smart strategic partnerships and top-notch management that is determined to bring its latest find, a uranium bonanza, from resource to mine by 2010. And that should put it in the catbird seat if uranium takes off the way I think it’s going to.

N.B (that's Latin for Nota Bene "note well", often used for endnotes). Here's the link to the official, shortened version of this story at MoneyandMarkets.com, if you're pressed for time...http://moneyandmarkets.com/press.asp?rls_id=385&cat_id=6&

I made some phone calls. Other people I trust aren't as worried about this as I am. They say that the gold market is still thin -- thinner than usual for this time of year -- as traders nurse volatility hangovers. A drop on thin trading activated a lot of stops -- no doubt set below that support I was harping about -- and the sell-off snowballed. New support is at 614-615.

I made some phone calls. Other people I trust aren't as worried about this as I am. They say that the gold market is still thin -- thinner than usual for this time of year -- as traders nurse volatility hangovers. A drop on thin trading activated a lot of stops -- no doubt set below that support I was harping about -- and the sell-off snowballed. New support is at 614-615.