News You Can Use for Tuesday

Chart of the Freakin' Day ...

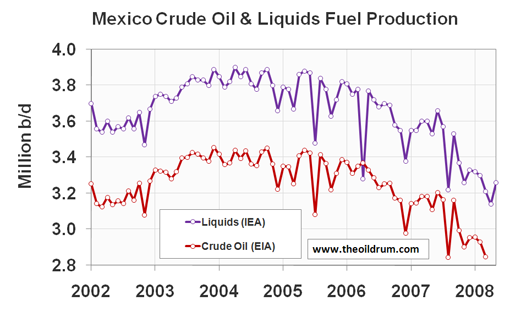

Mexico is the world's No. 6 oil producer and a key U.S. crude supplier but Pemex's oil output has declined this year due to waning yields at the aging Cantarell oil field and technical problems at wells in recent weeks.

The sheer hypocrisy of this debate on oil

Meanwhile the US Senate has threatened to launch a prosecution of OPEC for its alleged fixing of the world oil market, to the detriment of the American consumer. The American legislature's hypocrisy in this matter takes a different form to ours: the politicians who are now howling with rage about the shortage of oil supply are in essence the same people who have long blocked the oil industry from developing vast deposits both in the Arctic National Wildlife Refuge and off their own coastline - about 80 per cent of the US continental shelf is out of bounds, on environmental grounds.

Crude Oil Drops for Third Day on Concern Economic Slowdown May Curb Demand Crude oil fell for a third day on signs that slower economic growth in the U.S. and Europe will curb fuel consumption.

Nymex Oil Futures Price Averaged Over 200 Days Exceeds $100 for First Time Oil prices averaged over 200 days surpassed $100 a barrel for the first time on the New York Mercantile Exchange, an indication of the durability of a rally threatening global economic growth.

More News You Can Use

Stocks in US Show Negative Return on Inflation Gain

Surging commodity prices have eroded earnings and spurred the Federal Reserve to consider raising borrowing costs just as equities are trading at their most expensive in four years. Standard & Poor's 500 Index shares yield 0.22 percentage point more in profits than the interest on 10-year Treasury notes, the smallest advantage since 2004, data compiled by Bloomberg show. The last time corporate earnings returned less versus bonds, the index posted its first quarterly decline in more than a year.

The 39 percent advance in oil, 61 percent jump in corn and 41 percent climb in rice pushed the UBS Bloomberg Constant Maturity Commodity Index to a record this year. That's squeezing profits as raw-material costs outpace consumer prices by the largest margin since the 1970s. Companies in the S&P 500 will earn 7.7 percent less in the second quarter than a year ago, according to analysts' estimates compiled by Bloomberg.

Dollar Falls as Housing Decline Raises Bets Fed Will Delay Rate Increases The dollar fell against the euro after a government report showed housing starts dropped in May to a 17-year low, raising speculation the Federal Reserve will delay increasing borrowing costs this year.

Corn Advances Near to Record in Chicago as U.S. Crop Conditions May Worsen Corn traded close to a record on speculation the U.S. crop will suffer further damage from floods in the Midwest, potentially reducing production in the world's biggest producer and exporter.

US Wholesale Inflation Increased More than Forecast

Producers paid 7.2 percent more for goods from May 2007, compared with a 6.5 percent gain in the 12 months ended in April. Excluding food and energy, the increase was 3 percent from a year earlier, the same as in the prior month.

More on the rise in producer prices HERE.

China's Factory, Property Investment Climbs 25.6%

Urban fixed-asset investment rose to 4.03 trillion yuan ($585 billion) in the first five months from a year earlier, the statistics bureau said, after gaining 25.7 percent in the four months through April.

Mexico is the world's No. 6 oil producer and a key U.S. crude supplier but Pemex's oil output has declined this year due to waning yields at the aging Cantarell oil field and technical problems at wells in recent weeks.

The sheer hypocrisy of this debate on oil

Meanwhile the US Senate has threatened to launch a prosecution of OPEC for its alleged fixing of the world oil market, to the detriment of the American consumer. The American legislature's hypocrisy in this matter takes a different form to ours: the politicians who are now howling with rage about the shortage of oil supply are in essence the same people who have long blocked the oil industry from developing vast deposits both in the Arctic National Wildlife Refuge and off their own coastline - about 80 per cent of the US continental shelf is out of bounds, on environmental grounds.

Crude Oil Drops for Third Day on Concern Economic Slowdown May Curb Demand Crude oil fell for a third day on signs that slower economic growth in the U.S. and Europe will curb fuel consumption.

Nymex Oil Futures Price Averaged Over 200 Days Exceeds $100 for First Time Oil prices averaged over 200 days surpassed $100 a barrel for the first time on the New York Mercantile Exchange, an indication of the durability of a rally threatening global economic growth.

More News You Can Use

Stocks in US Show Negative Return on Inflation Gain

Surging commodity prices have eroded earnings and spurred the Federal Reserve to consider raising borrowing costs just as equities are trading at their most expensive in four years. Standard & Poor's 500 Index shares yield 0.22 percentage point more in profits than the interest on 10-year Treasury notes, the smallest advantage since 2004, data compiled by Bloomberg show. The last time corporate earnings returned less versus bonds, the index posted its first quarterly decline in more than a year.

The 39 percent advance in oil, 61 percent jump in corn and 41 percent climb in rice pushed the UBS Bloomberg Constant Maturity Commodity Index to a record this year. That's squeezing profits as raw-material costs outpace consumer prices by the largest margin since the 1970s. Companies in the S&P 500 will earn 7.7 percent less in the second quarter than a year ago, according to analysts' estimates compiled by Bloomberg.

Dollar Falls as Housing Decline Raises Bets Fed Will Delay Rate Increases The dollar fell against the euro after a government report showed housing starts dropped in May to a 17-year low, raising speculation the Federal Reserve will delay increasing borrowing costs this year.

Corn Advances Near to Record in Chicago as U.S. Crop Conditions May Worsen Corn traded close to a record on speculation the U.S. crop will suffer further damage from floods in the Midwest, potentially reducing production in the world's biggest producer and exporter.

US Wholesale Inflation Increased More than Forecast

Producers paid 7.2 percent more for goods from May 2007, compared with a 6.5 percent gain in the 12 months ended in April. Excluding food and energy, the increase was 3 percent from a year earlier, the same as in the prior month.

More on the rise in producer prices HERE.

China's Factory, Property Investment Climbs 25.6%

Urban fixed-asset investment rose to 4.03 trillion yuan ($585 billion) in the first five months from a year earlier, the statistics bureau said, after gaining 25.7 percent in the four months through April.

Check out my new gold and energy blog at MoneyAndMarkets.com

<< Home