Daily Blah

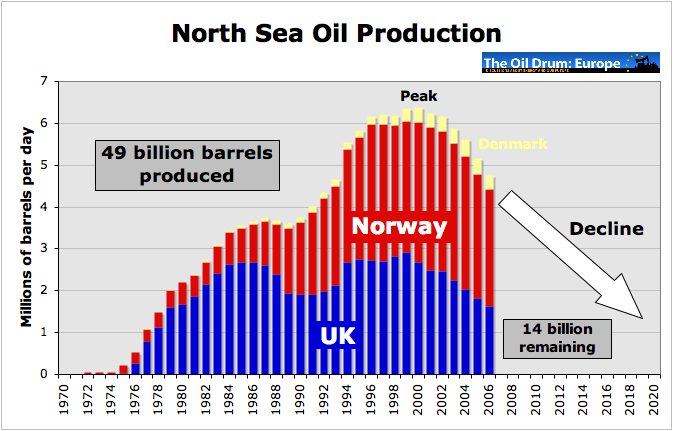

Chart of the freakin' day ...

You can see the original HERE.

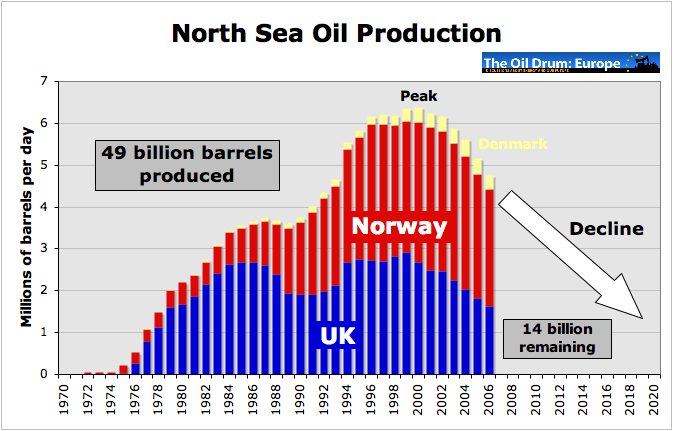

You can see the original HERE.

Gazprom expects oil to hit $250 a Barrel "in the foreseeable future". And at the same time, Citigroup boosted its 2008 Brent outlook 22 percent to $116.60 a barrel, while Merrill Lynch raised its forecast by 14 percent to $114. The International Energy Agency lowered its estimate for non-OPEC output this year by 300,000 barrels a day to 50.04 million, in its monthly report today.

Trade Gap in U.S. Widened in April to $60.9 Billion on Record Oil Imports The U.S. trade deficit widened in April as the surging cost of oil boosted imports to a record, overshadowing the biggest gain in exports in four years.

Corn Crop in U.S. May Shrink 10% as Midwest Rains Reduce Yields, USDA Says The U.S. corn harvest will be 10 percent smaller than a year ago as Midwest rains lower yields, the U.S. Department of Agriculture said. Inventories are projected to fall to a 13-year low.

Global Growth to Slow in 2008 on Higher Oil, Food Prices, World Bank Says Global economic growth will probably slow to 2.7 percent this year from 3.7 percent in 2007, checked by spiraling food and energy prices and the subprime credit crisis, the World Bank said.

Putting a face on "demand destruction." Senator Bernie Sanders collects stories of hardship caused by rising fuel costs and a downward economy. Some examples ...

You can see the original HERE.

You can see the original HERE.Gazprom expects oil to hit $250 a Barrel "in the foreseeable future". And at the same time, Citigroup boosted its 2008 Brent outlook 22 percent to $116.60 a barrel, while Merrill Lynch raised its forecast by 14 percent to $114. The International Energy Agency lowered its estimate for non-OPEC output this year by 300,000 barrels a day to 50.04 million, in its monthly report today.

Saudi Arabia Calls for Summit on Energy Costs After a cabinet meeting led by King Abdullah, the Saudi government said, “the increase in prices isn’t justified in terms of market fundamentals,” according to a statement from the official Saudi Press Agency. No date was given for the energy summit.

XX Sean's note -- talk is cheap.

Bernanke Tries to Talk Up the Dollar, Vows Pigs Will Fly XX Okay, that's not the real headline on this Bloomberg story, but it might as well be. Bernanke also says on inflation, "Who you going to believe? Me or your lying eyes?" Or as Bloomberg puts it ...Federal Reserve Chairman Ben S. Bernanke said policy makers will "strongly resist'' any surge in inflation expectations, delivering his clearest message yet the central bank is done lowering interest rates.Trade Gap in U.S. Widened in April to $60.9 Billion on Record Oil Imports The U.S. trade deficit widened in April as the surging cost of oil boosted imports to a record, overshadowing the biggest gain in exports in four years.

Corn Crop in U.S. May Shrink 10% as Midwest Rains Reduce Yields, USDA Says The U.S. corn harvest will be 10 percent smaller than a year ago as Midwest rains lower yields, the U.S. Department of Agriculture said. Inventories are projected to fall to a 13-year low.

Global Growth to Slow in 2008 on Higher Oil, Food Prices, World Bank Says Global economic growth will probably slow to 2.7 percent this year from 3.7 percent in 2007, checked by spiraling food and energy prices and the subprime credit crisis, the World Bank said.

Putting a face on "demand destruction." Senator Bernie Sanders collects stories of hardship caused by rising fuel costs and a downward economy. Some examples ...

- “We have at times had to choose between baby food and heating fuel.”

- “By February we ran out of wood and I burned my mother's dining room furniture.”

- “We also only eat two meals a day to conserve.”

- “My husband and I are very nervous about what will happen to us when we are old.”

Here is the IEA's latest Oil Market Report. And here is the EIA's International Petroleum Monthly. Some highlights of both ...

- Global oil supply rebounded by 490 kb/d in May to average 86.6 mb/d, lifted by higher OPEC crude supply. The rise however comes after extensive downward revisions to 1Q08 non-OPEC production.

- Global oil product demand is expected to average 86.8 mb/d in 2008, according to the IEA. So, you can see that supply already has trouble keeping up with demand.

- According to the IEA, in April, oil production fell by a whopping 1.09 million barrels per day, not 400,000 barrels per day as they thought last month. That's because the IEA comes out with their estimate way before the vast majority of countries report their production. So they can do nothing but guess.

- Non-OPEC production reached its current plateau in November of 2003, 4.5 years ago. In march non-OPEC production was 40.99 mb/d.

- According to the EIA, World oil (crude and condensate) production in March was down by 134,000 barrels per day to 74,494,000 barrels per day. Production in January and February were revised downward.

- March saw OPEC production drop 110,000 bp/d and non-OPEC production drop 24,000 bp/d.

Labels: agriculture, peak oil, US dollar, US economy

Check out my new gold and energy blog at MoneyAndMarkets.com

<< Home