Here’s the news on gold… Gold Gains for Seventh Day in London as Euro Touches Highest Since 2005

Gold rose for the seventh straight day as the euro touched its highest since March 2005 against the dollar, making the metal more appealing as an alternative investment to U.S. stocks and bonds. [To read more, CLICK HERE]

My view: Naturally, with everyone turning bullish on gold at once, the chance for a pullback is high. I’d wait for the pullback and use it as a chance to get in. If we miss it, well, RHAT and RCS portfolios already have plenty of precious metals in them.

What is driving this move? Well...

Dollar's Swoon May Continue

If Data Point to Hard Landing (WSJ subscription required)

TORONTO -- The dollar could be vulnerable to further damage this week after weakening sharply late last week.

Market thinness related to last week's Thanksgiving holiday may have exaggerated the dollar's losses, though there still remains a substantial risk that the selloff is more deeply rooted.

Shaun Osborne, chief currency strategist at TD Securities in Toronto, said the dollar's late-year downward break after months of mostly sideways range-trading is reminiscent of trading patterns in several recent years, when the dollar faded badly against major currencies in the last weeks of the year.

More pressure on the dollar can be expected if upcoming U.S. data releases trail forecasts to the extent that last week's latest jobless claims figures and consumer sentiment index releases did. They could inflame speculation about a hard landing for the economy and looming Federal Reserve interest rate cuts.

Significant U.S. data include the preliminary estimate of third-quarter gross domestic product growth Wednesday, as well as several housing market indicators scattered throughout the week and the November Institute for Supply Management index on Friday. [To read more, CLICK HERE]

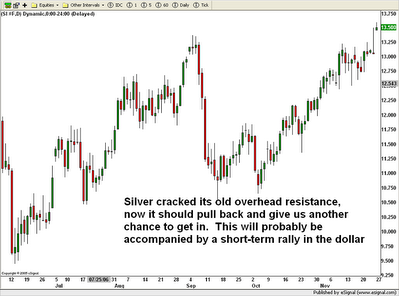

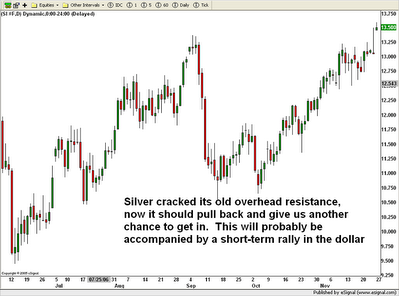

But how about silver? I'm glad you asked...

And what about oil? I’m glad you asked …

Oil Shares Signal a Rebound in Crude; Pickens Predicts Record 2007 Price

Oil stocks are signaling that crude prices may rebound to a record in 2007. Benchmark U.S. crude oil is likely to average $70 a barrel next year, according to Dallas hedge fund manager Boone Pickens. Economist Ed Morse at Lehman Brothers Inc., the fourth-largest U.S. securities firm, predicts $72. Either would top the average price for New York oil futures so far this year, $66.73 a barrel, and set a record. [To read more, CLICK HERE]

And don’t forget this one …

Oil Rises After Saudi Oil Minister Suggests Support for Another Output Cut

Finally, China, China, CHINA!

China's Economy May Expand as Fast as 10.7% in 2006 (Update3)

Nov. 25 (Bloomberg) -- China's economy, the world's fourth- largest, may expand as much as 10.7 percent in 2006, said Yao Jingyuan, chief economist at the National Bureau of Statistics. Gross domestic product may rise between 10 percent and 10.7 percent this year, Yao told reporters at a steel conference in Shanghai today. Growth close to the top of the range would exceed the World Bank's Nov. 14 estimate for China's economy to advance 10.4 percent in 2006. [To read more, CLICK HERE]

That would help explain this one …

Yuan Has Highest Close Since End of Dollar Link as Asian Currencies Climb

The yuan posted its highest close since the end of a fixed exchange rate to the dollar last year after Asian currencies the People's Bank of China uses to guide its exchange rate surged against the dollar. [To read more, CLICK HERE]

Good news on China should impact copper (positively). We'll see! Happy Monday, and good trades!

<< Home