Charts for Monday

I just got back from a long weekend at the Miami Book Fair (I found time to work on my new ETF report, so everyone's happy) . What a great time, with great authors. And books! They were selling great books for dirt-cheap prices! I have enough reading material for months.

Now, it's back to the markets. A weekend away can sometimes give you fresh perspective. Here are three charts I find interesting...

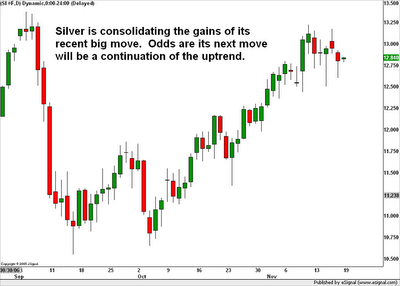

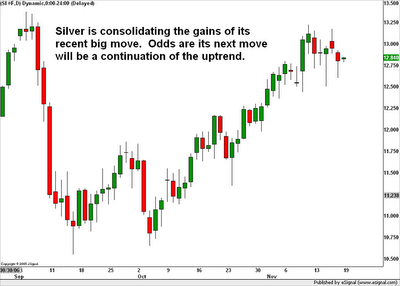

Silver spent last week consolidating, but it's still bullish. We could see more profit-taking, but I would expect it to make another attempt to push through overhead resistance at the $13.50 area.

Silver spent last week consolidating, but it's still bullish. We could see more profit-taking, but I would expect it to make another attempt to push through overhead resistance at the $13.50 area.

and then there's oil...

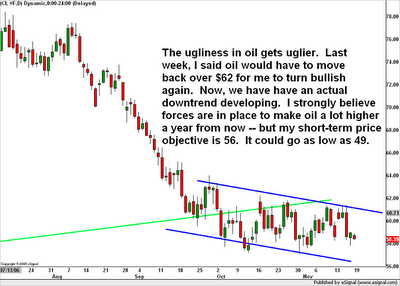

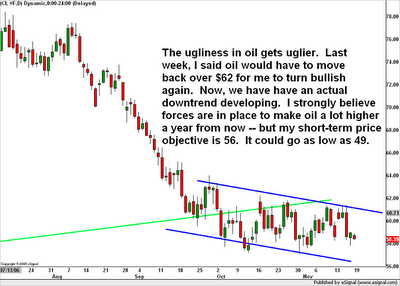

Oil skidded lower last week. Oil not only is failing to close above $62, it's in a down-trend. Fundamentally, it's due to warm weather up north and rising natural gas stockpiles. Psychologically, traders say the Democratic win of Congress seems to have taken a US attack on Iran off the table.

Things that could shake oil out of its downtrend include A) if OPEC cuts quotas again when it meets in December -- or if the market THINKS OPEC may cut again and B) when/if Old Man Winter finally take a bite out of the Big Apple.

For another perspective on that, let's look at the XLE (Energy Sector SPDR) divided by the S&P 500)...

For a long time the Energy sector outperformed the S&P 500. Now, hot money is flowing out of that sector. Will it flow back in? Stay tuned.

Now, it's back to the markets. A weekend away can sometimes give you fresh perspective. Here are three charts I find interesting...

Silver spent last week consolidating, but it's still bullish. We could see more profit-taking, but I would expect it to make another attempt to push through overhead resistance at the $13.50 area.

Silver spent last week consolidating, but it's still bullish. We could see more profit-taking, but I would expect it to make another attempt to push through overhead resistance at the $13.50 area.and then there's oil...

Oil skidded lower last week. Oil not only is failing to close above $62, it's in a down-trend. Fundamentally, it's due to warm weather up north and rising natural gas stockpiles. Psychologically, traders say the Democratic win of Congress seems to have taken a US attack on Iran off the table.

Things that could shake oil out of its downtrend include A) if OPEC cuts quotas again when it meets in December -- or if the market THINKS OPEC may cut again and B) when/if Old Man Winter finally take a bite out of the Big Apple.

For another perspective on that, let's look at the XLE (Energy Sector SPDR) divided by the S&P 500)...

For a long time the Energy sector outperformed the S&P 500. Now, hot money is flowing out of that sector. Will it flow back in? Stay tuned.

Check out my new gold and energy blog at MoneyAndMarkets.com

<< Home