More Evidence That Peak Oil Crisis Looms

There's an interesting story in the Wall Street Journal today ...

Oil Exporters Are Unable to Keep Up With Demand Fresh data from the U.S. Department of Energy show the amount of petroleum products shipped by the world's top oil exporters fell 2.5% last year, despite a 57% increase in prices, a trend that appears to be holding true this year as well. In all, according to the Energy Department figures, net exports by the world's top 15 suppliers, which account for 45% of all production, fell by nearly a million barrels to 38.7 million barrels a day last year. The drop would have been steeper if not for heightened output in less-developed countries such as Angola and Libya, whose economies have yet to become big energy consumers.

XX This story reinforces a point I made in my peak oil report "Running on Fumes." In fact, I listed it as "Force #5 -- Domestic Need is Squeezing OPEC Oil Exports." So if you bought my report, you were months ahead of the Wall Street Journal in knowing that domestic demand is rising so fast in the oil producing nations that their exports are going to go down, even if they pump more.

Meanwhile, about 2 billion people in China, India and other emerging markets are lined up to buy cars over the next 10 years. Now, I don't think they'll all buy cars -- I think the crisis we're rushing into will prevent that -- but it shows steadily growing demand that should squeeze prices much, much higher.

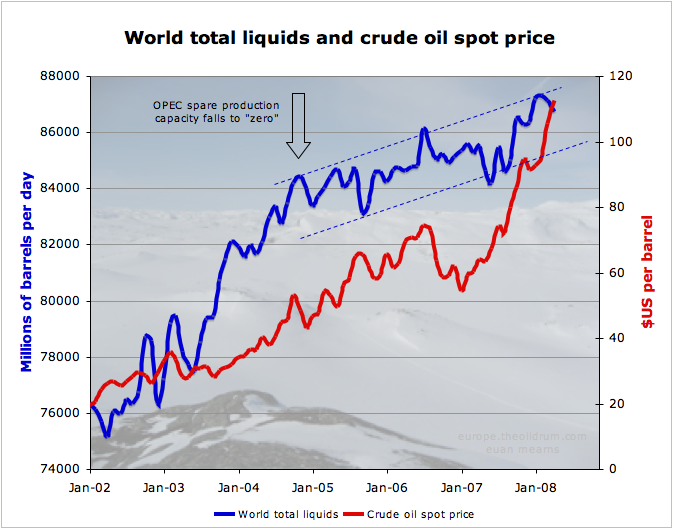

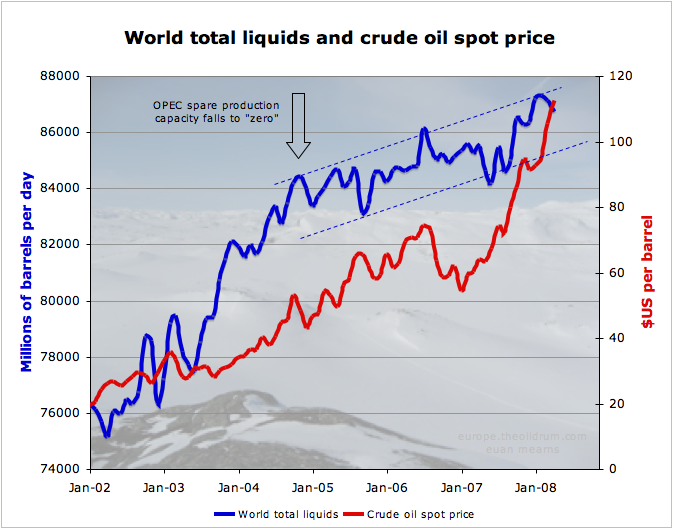

Next, let's look at this great chart that was on TheOilDrum this morning ... And this brings me to my point. I saw yet another talking head on CNBC saying that if only Congress would let us drill everywhere and increase domestic supply, we could solve this problem.

And this brings me to my point. I saw yet another talking head on CNBC saying that if only Congress would let us drill everywhere and increase domestic supply, we could solve this problem.

They. Just. Don't. Get. It.

What we need to solve is not supply but demand. Hell, if we have more oil, and don't stop our demand growth, we'll just use it up and be in the same leaky boat five years out. We need to change how America uses oil and use a lot less of it.

If we can seriously cut back on oil use -- conserve, conserve, conserve -- then I'll be happy to talk about drilling off the Atlantic shelf or whereever you want. My guess is, if we could cut US oil use by a third, we might be able to leave the decision on drilling in ANWR to our kids.

That said, according to the US Energy Information Administration, gasoline demand has fallen 0.6% so far in 2008, as consumers tighten their belts. If there was a lot less driving over the Memorial Day holiday -- and we'll find that out soon -- we could see the beginning of the short-term pullback in oil prices that I've been looking for since oil hit my short-term target of $127 a barrel.

Oil Exporters Are Unable to Keep Up With Demand Fresh data from the U.S. Department of Energy show the amount of petroleum products shipped by the world's top oil exporters fell 2.5% last year, despite a 57% increase in prices, a trend that appears to be holding true this year as well. In all, according to the Energy Department figures, net exports by the world's top 15 suppliers, which account for 45% of all production, fell by nearly a million barrels to 38.7 million barrels a day last year. The drop would have been steeper if not for heightened output in less-developed countries such as Angola and Libya, whose economies have yet to become big energy consumers.

XX This story reinforces a point I made in my peak oil report "Running on Fumes." In fact, I listed it as "Force #5 -- Domestic Need is Squeezing OPEC Oil Exports." So if you bought my report, you were months ahead of the Wall Street Journal in knowing that domestic demand is rising so fast in the oil producing nations that their exports are going to go down, even if they pump more.

Meanwhile, about 2 billion people in China, India and other emerging markets are lined up to buy cars over the next 10 years. Now, I don't think they'll all buy cars -- I think the crisis we're rushing into will prevent that -- but it shows steadily growing demand that should squeeze prices much, much higher.

Next, let's look at this great chart that was on TheOilDrum this morning ...

And this brings me to my point. I saw yet another talking head on CNBC saying that if only Congress would let us drill everywhere and increase domestic supply, we could solve this problem.

And this brings me to my point. I saw yet another talking head on CNBC saying that if only Congress would let us drill everywhere and increase domestic supply, we could solve this problem.They. Just. Don't. Get. It.

What we need to solve is not supply but demand. Hell, if we have more oil, and don't stop our demand growth, we'll just use it up and be in the same leaky boat five years out. We need to change how America uses oil and use a lot less of it.

If we can seriously cut back on oil use -- conserve, conserve, conserve -- then I'll be happy to talk about drilling off the Atlantic shelf or whereever you want. My guess is, if we could cut US oil use by a third, we might be able to leave the decision on drilling in ANWR to our kids.

That said, according to the US Energy Information Administration, gasoline demand has fallen 0.6% so far in 2008, as consumers tighten their belts. If there was a lot less driving over the Memorial Day holiday -- and we'll find that out soon -- we could see the beginning of the short-term pullback in oil prices that I've been looking for since oil hit my short-term target of $127 a barrel.

Check out my new gold and energy blog at MoneyAndMarkets.com

<< Home