Raymond James Sounds The Alarm on Natural Gas

I recommend you read the latest Raymond James Energy Industry brief. Update: Raymond James has changed the url on this report and it is not linkable. You can find it by going to: http://tinyurl.com/y83l3k and clicking on the November 27 "Energy Stat of the Week".

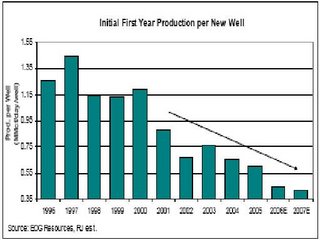

1) EOG’s work shows that overall U.S. gas decline rates have risen from roughly 21% in 1997 to an estimated 32% this year. Perhaps more importantly, first-year decline rates have increased sharply over the past several years to over 50% in 2005! We look for this trend to continue as operators increase activity in unconventional reservoirs (shales and tight sands) and extract more of the reserves earlier with improvements in completion technology.

3) We have shown that combining a conservative 31% base decline rate with our 2007 gas rig forecast of 1,560 (12% year-over-year increase), new production will not keep pace with production declines. Looking ahead to 2007 and beyond, we believe continued increases in unconventional drilling activity and improvements to completion technology should further exacerbate the problem and may in fact leave the gas market undersupplied.

Some excerpts...

1) EOG’s work shows that overall U.S. gas decline rates have risen from roughly 21% in 1997 to an estimated 32% this year. Perhaps more importantly, first-year decline rates have increased sharply over the past several years to over 50% in 2005! We look for this trend to continue as operators increase activity in unconventional reservoirs (shales and tight sands) and extract more of the reserves earlier with improvements in completion technology.

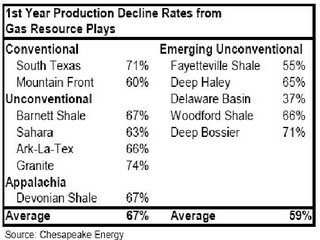

2) Chesapeake Energy is the most active driller in the U.S., with a  meaningful presence in several of the hottest E&P areas. As shown in the table below, virtually every one of Chesapeake’s major producing areas is seeing first-year decline rates above 50%, and the average is closer to 65%. Keep in mind that Chesapeake has been one of the more successful U.S. gas operators. With a typical first-year decline rate exceeding 50% in many of the other unconventional gas resource plays, it is hard to imagine that the decline rate treadmill will not continue its upward trend.

meaningful presence in several of the hottest E&P areas. As shown in the table below, virtually every one of Chesapeake’s major producing areas is seeing first-year decline rates above 50%, and the average is closer to 65%. Keep in mind that Chesapeake has been one of the more successful U.S. gas operators. With a typical first-year decline rate exceeding 50% in many of the other unconventional gas resource plays, it is hard to imagine that the decline rate treadmill will not continue its upward trend.

meaningful presence in several of the hottest E&P areas. As shown in the table below, virtually every one of Chesapeake’s major producing areas is seeing first-year decline rates above 50%, and the average is closer to 65%. Keep in mind that Chesapeake has been one of the more successful U.S. gas operators. With a typical first-year decline rate exceeding 50% in many of the other unconventional gas resource plays, it is hard to imagine that the decline rate treadmill will not continue its upward trend.

meaningful presence in several of the hottest E&P areas. As shown in the table below, virtually every one of Chesapeake’s major producing areas is seeing first-year decline rates above 50%, and the average is closer to 65%. Keep in mind that Chesapeake has been one of the more successful U.S. gas operators. With a typical first-year decline rate exceeding 50% in many of the other unconventional gas resource plays, it is hard to imagine that the decline rate treadmill will not continue its upward trend.3) We have shown that combining a conservative 31% base decline rate with our 2007 gas rig forecast of 1,560 (12% year-over-year increase), new production will not keep pace with production declines. Looking ahead to 2007 and beyond, we believe continued increases in unconventional drilling activity and improvements to completion technology should further exacerbate the problem and may in fact leave the gas market undersupplied.

Labels: natural gas

Check out my new gold and energy blog at MoneyAndMarkets.com

<< Home