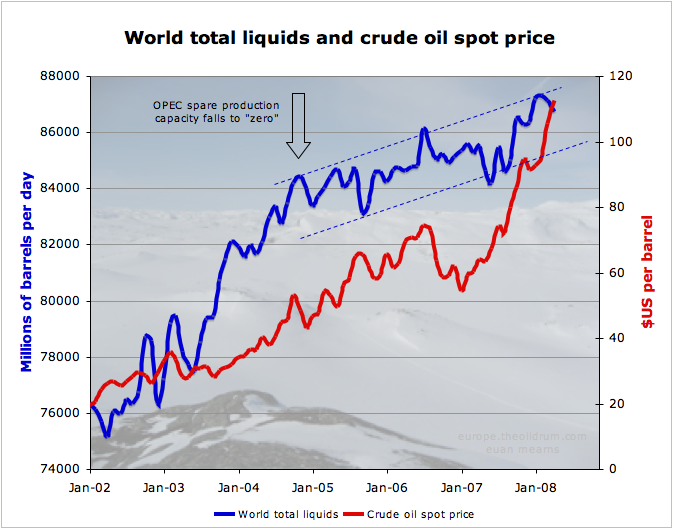

Saudi Arabia said on Friday that it would raise its daily output by 300,000 barrels per day … Angola is scheduled to start shipping a new blend of crude oil in July, boosting production by about 90,000 barrels a day… Iraqi oil production rose to more than 2.5 million barrels a day last week, the highest this year…

... and yet crude oil shrugged off all this “bad news,” threw back its soot-black face and laughed, and kept on climbing to higher prices on Monday.

By just about any metric, crude oil is overbought and due for a pullback. However, the Chinese may have something to say about it. The Chinese are hoarding diesel fuel ahead of hosting the Olympics this August. You see, the Chinese don’t trust their power grid, so they’re positioning emergency generators all over the place to keep the lights on if the grid goes snafu.

And since the prices of oil, diesel and gasoline are made on the margins, China’s demand for diesel is having an effect on what you pay at the gas pump.

Americans are the world’s biggest users of gasoline and oil, and Americans are cutting back their demand. So when China’s demand sets global prices, that’s a bit like the tail wagging the dog.

But the fact is, Chinese fuel demand is growing rapidly, buoyed by state subsidies that keep prices low for consumers and keep their magic growth engine humming along. Since we ship China more and more of our money every day in return for lead-painted toys, poisoned dog food and other gee-gaws, the government there isn’t going to run out of money to subsidize fuel anytime soon.

And there are about 2 billion people in China, India, and other emerging markets who want to hop in a car and drive, baby drive like big, fat Americans. In the long-term, they’ll use every gallon we don’t.

But we could still experience a steep, even head-snapping correction in the short term. We just need demand destruction quickly enough in the OECD (Organization for Economic Co-operation and Development) countries. And we may get it.

U.S. jet fuel demand in April dropped to its lowest level in five years – down 6.2% to 1.549 million barrels per day.

Gasoline demand in the U.S. is down slightly, and could drop more. Mastercard, the nation’s second biggest credit card company, said that U.S. gasoline demand fell 5.8% in the week ending May 2 when compared to the same week a year earlier. Demand fell 2.5% from the previous week. If oil prices stay high, U.S. gasoline consumption could fall to 8 million barrels a day by the end of 2009 instead of rising very slightly to 9.33 million barrels a day as the Energy Department’s Energy Information Administration (EIA) predicts.

And we could use a lot less. In a comparison that will surely set George Bush’s teeth on edge, your average Frenchman, for example, uses about 16% of the gasoline per capita that the average American does.

In the short term, we’ve noticed – as you probably have too – that it’s just when things look hottest in commodities that a reversal in one direction or another can happen. Bottom line: Oil could go either way.

Meanwhile, while President Bush was in the Middle East, he told OPEC nations that they're running out of oil. Well, the President already said that America is addicted to oil, so isn't that a little like a junkie telling his pusher that the pusher is running out of smack. Who do you think is really going to suffer here? Thanks for the heads-up, Georgie-boy. And OPEC has nixed the idea of calling an early meeting to boost production.

So crude oil shrugs its shoulders, and keeps climbing. We'll see what happens when the oil inventory numbers come out tomorrow.

Labels: crude oil