XX Sean's note -- my MoneyandMarkets.com column for Wednesday is being trimmed a lot because I am too darned windy. I can see my editor's point. However, if you have an interest in history, especially the Dust Bowl and Great Depression, you might like the longer, uncut version. Here you go ...

A huge bull market in commodities suddenly takes a downturn. Equities are getting clobbered. The nation is groaning under insurmountable debts after the banks throw caution to the wind.

It’s an election year, and some people say the market is over-regulated – others that it’s not regulated enough. And weird weather is making headlines – in fact, some people think the weather could herald the beginning of the end.

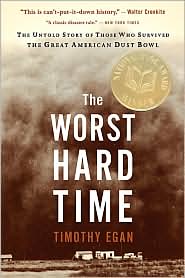

It may sound like the U.S. in the 21st Century, but it’s also our country on the brink of the Great Depression. It’s a story told in the book “The Worst Hard Time,” by Timothy Egan. I highly recommend this National Book Award winner to you. It is a fascinating glimpse of a time that has vanished from all but the longest memories. And it offers great insights into today’s markets and economic climate.

brink of the Great Depression. It’s a story told in the book “The Worst Hard Time,” by Timothy Egan. I highly recommend this National Book Award winner to you. It is a fascinating glimpse of a time that has vanished from all but the longest memories. And it offers great insights into today’s markets and economic climate.

Does that mean I think that America is on the slippery slope of a Depression? No, there are differences, too. But the similarities make for great lessons that can help all of us today.

A Shot at the American Dream

Egan’s story starts in the last free land in America – the Oklahoma panhandle. After the original (native) inhabitants were chased off, settlers could stake out up to 640 acres and take their shot at the American dream.

That part of the country – including surrounding areas of Texas, Colorado and Kansas – was marginally farmable land that marketers palmed off on unsuspecting new arrivals, the kind of folks who believed in tomorrow because it was all they had in the bank. As Egan explains …

“Hope died the first time people laid eyes on Boise City, Oklahoma. It was founded on fraud. Even the name itself was a lie … from the French word le bois – trees. Except there was not a single tree in Boise city. Nor was there a city. On Boise City’s imaginary streets, the buyers found stakes in the ground and flags flapping in the wind. No railroads. No tracks. No plans for railroads. No fine houses. No businesses. Worst of all, the company did not even own the land that it sold.”

Despite this inauspicious start, people did scratch a living from the land in Boise City and other towns and hamlets in the panhandle. Home was often a hole dug out of the sod, covered with boards and shared with tarantulas, snakes and so many centipedes that they crunched underfoot.

“The flattest, driest, most wind-raked, least arable part of the United States was transformed by government incentive, private showmanship, and human desire from the Great American Desert into Eden with a haircut. Settlement was a dare, on a grand scale, to see if people could defy common sense.”

But it was a life, and for many, the only home they knew. And for a while it seemed that heaven smiled on this venture – a decade of wet years made farming in the panhandle a breeze.

New technology reshaped the world of the 1920s – for farmers, the ride of choice was the tractor. In the 1830s, it took 58 hours of work to plant and harvest a single acre. By 1930, it took only three hours for the same job. A tractor did the work of 10 horses and took a lot less maintenance.

In their eagerness to reap as much of a profit as they could, the farmers plowed the tough prairie grass under and planted wheat. With the price of wheat at 80 cents a bushel, they reaped profits.

The problem started in 1915, when, with a war in Europe raging, the government guaranteed the price of wheat at $2 a bushel. The person in charge of this program was named Herbert Hoover. You may have heard of him. Thanks to Hoover’s government largesse, soon every idiot who could scratch a stick in the ground was trying to wrest his fortune from prairie soil.

This was no flash-in-the-pan bubble. It lasted 14 years.

By 1926, the self-described Wheat Queen of Kansas, Ida Watkins, told everyone she made a profit of $75,000 on her two thousand acres – bigger than the salary of any politician, and more money than any star athlete but Babe Ruth himself.

“Life in America in September 1929 was almost too sweet, too bountiful, too full of riches,” Egan writes.

Before the wheat boom, banks refused to lend to farmers west of the 98th  meridian on the grounds that it was “too dry.” Then Congress passed the Federal Farm Loan Act in 1916, and banks offered 40-year loans at 6% interest to any man who had a farm to work.

meridian on the grounds that it was “too dry.” Then Congress passed the Federal Farm Loan Act in 1916, and banks offered 40-year loans at 6% interest to any man who had a farm to work.

The farmers turned around and used that money to buy tractors, which in the good times provided more than enough income. And more and more land went under the plow.

All good things must end. By 1929, America had a grain surplus. Prices crashed … but the farmers still had loans to pay.

The only way for someone who made $10,000 in 1925 to duplicate his earnings in 1929 was to plant twice the amount. At least, that was the theory. Soon, unsold wheat piled up next to the railroad track. By 1930, land that once brought an income of $4,000 now brought only $400!

What’s the Worst That Can Happen?

And things got worse! The price of wheat actually went to ZERO – that’s what farmers were told they would get if they brought any more of that damned grain near the station.

Since farmers had no income, they couldn’t repay loans. 1930 saw the first widespread bank failures. The town thrifts closed their doors forever, taking what little money farmers had left with them. And then, that same year, the weather changed. The marginally farmable land of the panhandle could produce a crop of wheat during wet years, but that part of America tipped into a full-scale drought. The land simply dried up and blew away.

But it didn’t go peacefully. Instead, dust storms raged across the landscape. From the first-hand descriptions, the best I can come up with is a dust storm is like being forcibly stuffed into an industrial clothes dryer and tumbled around with a load of dirt … only 100 times worse.

The clouds of dirt would pile up 10,000 feet high and march across the prairie, looking, as one eyewitness recalled, like a range of mountains on the move. The storms blew out windows, buried cars and tractors, fried food with static electricity caused by all that dirt rubbing together, suffocated animals where they stood and filled the lungs of every living thing. The storms were killers of animals, men, women and children.

Black Sunday

One storm, in 1934, blew up a great rectangle of dust from the Great Plains to the Atlantic, 1,800 miles wide, and laden with 350 million tons of dust – three tons of dust for every American alive at the time.

The worst storm, known as Black Sunday, hit on April 14, 1935, and carried twice as much dirt as was ever dug out of the Panama Canal.

Faced with nature’s furious onslaught, many people ran for their lives. Ten thousand people a month fled the Great Plains, the biggest single exodus in American history. Still, many others stayed … either too stubborn or too poor to move along.

The Dust Bowl was the physical manifestation of the nation’s financial and emotional sickness, problems that turned the election of 1932 into a lightning rod for “change.” The candidates talked about being the real agent of change. Sound familiar?

Vote for me, I’m an Agent of Change!

The Republicans stuck by their President, Herbert Hoover. Hoover believed the cure for the Depression was to prime the pump at the producer end, helping factories and business owners get up and running again. Goods would roll off the lines and prosperity would follow.

The Democrats had two main candidates.

One, William "Alfalfa Bill" Murray (right) was born in Toadsuck, Texas, but rose to become Governor of neighboring Oklahoma by railing against what he called “The Three C’s – Corporations, Carpetbaggers and Coons.” With the Presidential election looming, populist Democrat Murray ran for the nomination on the “Four B’s – Bread, Butter, Bacon and Beans.” The problem, he said, was that America had gone soft.

become Governor of neighboring Oklahoma by railing against what he called “The Three C’s – Corporations, Carpetbaggers and Coons.” With the Presidential election looming, populist Democrat Murray ran for the nomination on the “Four B’s – Bread, Butter, Bacon and Beans.” The problem, he said, was that America had gone soft.

Half the country was going hungry – Murray’s message resonated. They also liked that Murray hated socialists even more than he hated corporations.

The other Democratic candidate was an East-Coast swell named Franklin Delano Roosevelt. FDR’s platform was to give people jobs with a huge public works program to build America’s infrastructure.

FDR beat Murray on the third ballot at the convention. Outraged, the titan from Toadsuck switched party affiliations to Republican. But he found himself on the wrong side of history.

FDR is famous for getting America through the Depression. Along with Social Security and other landmark programs, much of his energy was focused on stopping the Dustbowl, which spread like a cancer in America’s heartland.

At its peak, the Dust Bowl covered one hundred million acres. By the end, some scientists estimated that more than 80 million acres in the southern plains were stripped of their topsoil.

But with FDR’s leadership, the problem wasn’t insurmountable.

- Four million acres of farmland were abandoned – the farms bought up and the people moved away.

- Young men were paid a dollar a day in the Civilian Conservation Corps to plant trees from the North Dakota border with Canada all the way to Amarillo, Texas.

- A government program taught farmers a new way to till the soil and farmers agreed to abide by strict soil conservation standards.

- New technology allowed those farmers who remained to tap the Ogallala aquifer – a subterranean body of water as large as Lake Superior – in even the driest times.

By these combined efforts, the Dustbowl was tamed. Thanks to these and other new programs, the country emerged from its economic slumber. Here’s what I think we can learn from history …

Lessons from the Dustbowl

Good laws are good for business. Hoover said regulation was the wrong thing at the wrong time, and would slow down the recovery. His opponent, FDR railed against crooked bankers and called for more regulation. The public weighed the facts and sided with FDR. His bank holiday and subsequent regulation restored America’s faith in his banks.

Last week, we just saw the government pony up $30 billion of taxpayer dollars to enable one bunch of sharks in pinstripe suits to buy another. Some of the financial instruments that got Bear Stearns in trouble are so complicated that ordinary people can’t understand them. I think it’s time for more regulation, not less.

Not all change is good! Can you imagine what this country would have been like if racist demagogue William Murray won the 1932 election?

All the candidates in the current Presidential election say they’re agents of real change. Senator John McCain is relying on former Senator Phil Gramm as his chief economic advisor. Gramm, a long-time foe of regulation, is one of the people responsible for letting unregulated institutions — the “shadow banking system” – take over the roles traditionally filled by regulated banks. In other words, the current banking crisis has his fingerprints all over it.

Sen. McCain may want to reconsider his reliance on Sen. Gramm. That kind of change we don’t need.

Bull markets can end with a bang. The 1929 bull markets in both grain and equities ended rather suddenly, when everything looked GREAT. This is a reminder to all of us to keep one eye on the exit even in the best markets.

That said, I don’t think we’re anywhere near the end of the current grain bull market. After falling hard and fast last week, grain prices are moving higher again.

Why? This time around, US farmers aren’t just feeding America. They’re feeding the world. And the world has never been hungrier.

World wheat inventories are expected to fall to 110.4 million metric tons in the year ending May 31, the lowest since 1978, the U.S. Department of Agriculture said on March 11. U.S. supplies may drop to 6.6 million tons, down 47 percent from a year earlier, the USDA said.

Meanwhile, floods in the nation’s midsection are delaying soybean and corn crops. And out in the old Dustbowl, parts of western Kansas, the Oklahoma Panhandle and West Texas received so little rain in the past month that the winter wheat crop may be hurt.

And it’s not just grains that are looking good. Check out this chart of the CCI Index, an equally weighted basket of commodities. It shows the bull market that began in 2001 is still going strong.

This bull market will end someday – all bull markets do – but bull markets in commodities last an average 15 years. I think our commodity bull has a long way to go.

And that makes the pullback we’re seeing now one heck of a buying opportunity.

Labels: agriculture, History, MoneyandMarkets.com

Dollar Falls to Near Record Low Against Euro as Inflation Accelerates The dollar headed for its biggest quarterly loss against the euro since 2004 after inflation accelerated in the common-currency bloc, giving the region's central bank more reason to keep interest rates unchanged while the Federal Reserve lowers borrowing costs.

Dollar Falls to Near Record Low Against Euro as Inflation Accelerates The dollar headed for its biggest quarterly loss against the euro since 2004 after inflation accelerated in the common-currency bloc, giving the region's central bank more reason to keep interest rates unchanged while the Federal Reserve lowers borrowing costs. Crude Oil Declines a Second Day on U.S. Economic Slowdown, Iraqi Exports Crude oil fell for a second day in New York on speculation slowing economic growth in the U.S., the world's biggest energy consumer, will curb demand.

Crude Oil Declines a Second Day on U.S. Economic Slowdown, Iraqi Exports Crude oil fell for a second day in New York on speculation slowing economic growth in the U.S., the world's biggest energy consumer, will curb demand. Soybeans in Chicago Rise on China Demand Expectation, Wheat, Corn Advance Soybeans advanced, heading for a sixth quarterly increase, on expectations China, the world's largest buyer of the oilseed, will step up purchases after damage to its rapeseed crop. Wheat fell and corn climbed.

Soybeans in Chicago Rise on China Demand Expectation, Wheat, Corn Advance Soybeans advanced, heading for a sixth quarterly increase, on expectations China, the world's largest buyer of the oilseed, will step up purchases after damage to its rapeseed crop. Wheat fell and corn climbed.  Palladium Market May Have Supply Deficit Next Year, Societe Generale Says Palladium production will fall 65,000 ounces short of demand next year, the first deficit in at least five years, partly because jewelers and automakers will switch from more expensive platinum, Societe Generale SA said.

Palladium Market May Have Supply Deficit Next Year, Societe Generale Says Palladium production will fall 65,000 ounces short of demand next year, the first deficit in at least five years, partly because jewelers and automakers will switch from more expensive platinum, Societe Generale SA said. Gold Gains on Speculation Dollar May Drop as US Economy Slows

Gold Gains on Speculation Dollar May Drop as US Economy Slows

Sure, we can have more downside in commodities. But the big commodity supercycle is real. Some speculative money rushing for the exits won't change that.

Sure, we can have more downside in commodities. But the big commodity supercycle is real. Some speculative money rushing for the exits won't change that.