A Tale of Two Currencies

Meanwhile, the US dollar closed back above its 20-day moving average. This is short-term oversold. We may be in for a furious short-covering rally.

Meanwhile, the US dollar closed back above its 20-day moving average. This is short-term oversold. We may be in for a furious short-covering rally.

Labels: US dollar

"Luck is not chance, it’s toil; fortune’s expensive smile is earned.”

Meanwhile, the US dollar closed back above its 20-day moving average. This is short-term oversold. We may be in for a furious short-covering rally.

Meanwhile, the US dollar closed back above its 20-day moving average. This is short-term oversold. We may be in for a furious short-covering rally.

Labels: US dollar

I like to look at monthly charts from time to time, as do other analysts. This next chart shows why technicians have been selling gold recently ...

I like to look at monthly charts from time to time, as do other analysts. This next chart shows why technicians have been selling gold recently ... I don't agree with their view, but they're entitled to it. Now, how about gold stocks?

I don't agree with their view, but they're entitled to it. Now, how about gold stocks? We often see gold stocks lead the metal higher, and I think that's what we could see this time. Finally, let's look at oil ...

We often see gold stocks lead the metal higher, and I think that's what we could see this time. Finally, let's look at oil ... I'm on wait-and-see with crude.

I'm on wait-and-see with crude. Labels: crude, gold, interest rates

#3) You might think a rising greenback would send gold lower, but that's not the case. Why? Probably because everyone is starting to price in another rate cut, which is inflationary ...

#3) You might think a rising greenback would send gold lower, but that's not the case. Why? Probably because everyone is starting to price in another rate cut, which is inflationary ...Labels: China, gold, uranium, US economy

Labels: MoneyandMarkets.com

You know my view on this: Words mean nothing in the oil market. Let's wait and see before we start celebrating.

UPDATE: The new IEA oil market report is out, and it says oil production up by 1.41 million barrels per day in October for new record of 86.43 million barrels per day.

Story #4: Minyanville (a financial site that is also a fun read) is giving a double-sell signal on gold ... based on appearances of Mr. T. I wish I was making that one up. Alternately, you might want to read: Gold: The Crash Market Stock

Story #5: Consumer confidence is falling off a cliff. U.S. consumer confidence fell to its lowest level since Hurricane Katrina in the fall of 2005, the Conference Board reported Tuesday. The index fell almost seven points, to 87.3 from 95.2, well below the 90.2 economists had forecasted. It was also the biggest one-month decline in two years.

Story #6: Fuel Quest May Create Food Crisis. THE world is in danger of running out of basic foodstuffs, according to a leading Australian economist. The shortage will create further dramatic price rises in essential grains such as wheat and corn, accompanied by a tightening of supply, says ABN Amro Morgans chief economist Michael Knox. In the 2004 financial year, corn consumption was 647 million tonnes; this financial year it is expected to be more than 760 million tonnes – an increase approaching 20 per cent in just four years.

Labels: crude oil, global warming, gold, uranium, US economy

The London-based consultancy said oil shipments from 11 OPEC members, including Iraq, averaged 22.48 million bpd on a moving average basis to Nov. 11, down from 22.82 million bpd for 15-28 October loading.

So why is OPEC shipping less AFTER it says it raised production quotas? Part of it could be the outage of major oilfields in the United Arab Emirates. But that doesn't explain everything.Labels: crude oil

10 Stories You Should Read This Morning …

The decision to use derivatives to short, or bet against, low-quality US home loans taken by a select group of hedge funds last year appears to have become the most profitable single trade of all time, making well over $20bn in total so far this year. John Paulson’s New York-based Paulson & Co, the biggest of the group with $28bn under management, is said by investors to have made $12bn profit from the trade already.

However, Mr Lahde, whose fund is one of the smallest specialists shorting subprime, has now begun to return money to investors, telling them in a letter: “The risk/return characteristics are far less attractive than in the past.”

In his letter, Mr Lahde said he expected the collapse in value of subprime mortgage-linked securities to be repeated for bonds backed by commercial property loans in a deep recession – which he also predicts.

“Our entire banking system is a complete disaster,” he wrote. “In my opinion, nearly every major bank would be insolvent if they marked their assets to market.” He also said he would be putting some of his own profits into gold and other precious metals.

Oil exporters, including

3) While the news for Detroit gets worse and worse, there are plenty of American car makers who are working on the next big thing. Here are some of the cars you may be driving 10 years from now

4) Holiday Sales in U.S. Climb on Discounts; Individual Shoppers Cut Spending Sales gained in the days after the U.S. Thanksgiving holiday as retailers lured more customers with discounts even as individual shoppers spent less on average.

5) Worst Month for Stocks Since 2002 Shows Smallest Companies May Be Cheapest The cheapest small-cap stocks in four years are luring equity investors battered by the biggest monthly losses since 2002.

6) BHP Billiton Bid for Rio Tinto Loses Confidence of Investors, Steelmakers BHP Billiton Ltd., the world's largest mining company, is losing the support of investors and steelmakers for its proposed $128 billion takeover of Rio Tinto Group.

Also … Australia's S&P/ASX 200 Index rose the most for more than two months, led by Rio Tinto Group on reports China Investment Corp. may counter BHP Billiton Ltd.'s takeover bid for the world's third biggest mining company.

7) Dollar Displaces Yen, Franc as Favorite for Carry Trades With Rand, Real Using the dollar to pay for purchases of currencies with higher yields is proving to be the most profitable trade in the foreign-exchange market.

8) Areva Wins Record $11.9 Billion in Nuclear Reactor Contracts From China Areva SA won an 8 billion euro ($11.9 billion) agreement from

XX Sean’s note – Areva often sells reactors with the agreement that if you buy their reactor, they’ll supply you the fuel. Look for Areva to make more mining acquisitions.

9) Gold Gains for Third Consecutive Day on Weaker Dollar, Stronger Crude Oil Gold climbed for a third consecutive day in London as oil rose and the dollar declined against the euro, spurring demand for the metal as an alternative investment.

10) Soybeans Rise to 34-Year High in Chicago on Demand Outlook; Soy Oil Gains Soybeans in Chicago rose to the highest in 34 years on speculation a weaker dollar and rising oil prices may compound surging Chinese demand.

Here's a note, from currency analyst Boris Schlossberg: “Tuesday could prove to be a more exciting day for dollar traders, as the Conference Board’s consumer confidence survey for the month of November is expected to support more cynical retail sales predictions, as the index may drop for the fourth consecutive month to a two-year low of 91.0 in the face of record high gasoline prices and declines in the stock markets. If this is indeed the case, fed fund futures will likely continue to suggest that investors are ramping up speculation of a December rate cut by the Federal Reserve, leaving the US dollar open to further declines.”

On a holiday note: The cost of 5 golden rings, bought over the internet, is up 20% year over year.

Labels: Canada, commodity supercycle, crude oil, gold, Red-Hot Canadian Small-Caps, US dollar, US economy

Thanksgiving is a holiday where you often have to talk to people you usually avoid, including members of your family. In case you run out of topics, here are a few things you can discuss…

Taj Mahal No Longer Accepts US Dollars. Foreign tourists to many of India's most famous landmarks will no longer be able to pay the entrance fee in dollars, the government says.

Giant sea scorpion bigger than man

I'm thinking this has SciFi channel movie written all over it.

A new planet has been detected around a nearby sun-like star, orbiting at a distance where water would exist in liquid form

According to Congress' Joint Economic Committee, the Iraq War has cost $1.6 trillion dollars, or, (and this is supposed to be the clinching argument) $20,000 for every American family.

Astronomy Nerds Need to Get Out More. These guys say that we've hastened the universe's demise by looking at it. Seriously, do they think God is going to punish us for being the Peeping Toms of the universe?

Last Thanksgiving, I was very bullish on uranium. Obviously, I was a little ahead of the game, but I doubt I'm wrong. In fact, I'm getting very bullish again.

Have a wonderful and happy Thanksgiving.Labels: agriculture, commodity supercycle, natural gas

Labels: MoneyandMarkets.com

Click on the chart for a larger image. Some important points ...

Standard & Poor's U.S. corporate earnings projections for Q3 has slipped from prior levels, and are now negative for the quarter. On a year-over-year basis, the S&P 500 earnings are expected to decline 8.48% from Q3 2006, marking the first such negative quarter since 2001 (-24.2%).

As recently as October, the consensus estimates were for a gain of 3.3%.

Consumer discretionary is the big loser, down 38.94%. Financials are a close second, down 33.15%. I'd expect those financials earnings to continue to deteriorate.

But even sectors you think would be immune are getting hit. Check out energy -- in the second quarter, earnings were up 8.7% year over year. In the third quarter, earnings are projected to fall 9.92% year over year.

Labels: US economy

On Friday night, during what the participants thought were private talks, Venezuela's oil minister Venezuela Rafael Ramirez and his Iranian counterpart Gholamhossein Nozari, argued that pricing — and selling — oil using the crippled dollar was damaging the cartel.

They said OPEC should formally express its concern about the weakness of the dollar when the cartel makes its official declaration at the close of the summit today. But the Saudis, the world's largest oil producers and de facto head of OPEC, vetoed the proposal. Saud al-Faisal, the Saudi foreign minister, warned that even the mere mention to journalists of the fact that leaders were discussing the weak dollar would cause the US currency to plummet.

Unfortunately his words and those of everyone at the meeting were being broadcast via a live television feed to a group of astonished reporters.

'Kill the cable, kill the cable,' shouted the security guard as he burst through the double doors into the media room at the Intercontinental Hotel in Riyadh, followed by Saudi police. It was too late.“The Dollar Peg Is Doomed!”

Here’s an update of the story I had on my blog yesterday …

Merrill Lynch & Co. predicts either the

``The dollar peg is doomed,'' said Jim Rogers, chairman of New York-based Rogers Holdings and a former partner of hedge fund manager George Soros.

Here are some other news stories of interest ...

Not surprisingly …

OPEC Comment Drives Oil Close to $95

Oil prices rose Monday with more talk among OPEC members about converting their cash reserves to the euro and away from the U.S. dollar. There is also doubt a possible OPEC output hike next month would get more supplies to market in time for the northern winter.

Gold higher on firm oil; capped below $800

Iranian President Mahmoud Ahmadinejad said Sunday that OPEC's members have expressed interest in converting their cash reserves into a currency other than the depreciating U.S. dollar, which he called a "worthless piece of paper."

I'll post a chart of the dollar when blogger gets over its snit fit.Labels: US dollar

Monthly net TIC flows were minus $14.7 billion. Of this, net foreign private flows were negative $27.8 billion, and net foreign official flows were positive $13.1 billion.

This is an improvement over August, when foreigners pulled $69.3 billion out of the US market. Still, it's not good news for broad equities. It should put more downward pressure on the US dollar, which in turn puts upward pressure on gold.

Why are foreigners pulling their money out? Well, other economies are growing much faster than the US, so why not invest your money there? For example, the World Bank has raised its forecasts for China twice this year, predicting Asia's second-largest economy will grow 11.3%. For now, the World Bank is forecasting that the US economy will grow 1.9% this year. Add that to the fact that the US dollar is trending down against most major currencies, and you can see why people might want to put their money to work elsewhere.

Labels: China, gold, US economy

Wells Fargo Exec: Housing at worst point since Depression Wells Fargo & Co. Chief Executive Officer John Stumpf said the current housing market is the worst since the Great Depression. The leader of the second-largest

Goldman Sachs: U.S. could face $2 trillion lending shock (Reuters) - The impact of the

U.S. Risks Recession on Subprime Losses, Greenspan's Legacy, Stiglitz Says Joseph Stiglitz, a Nobel-prize winning economist, said the U.S. economy risks tumbling into recession because of the subprime crisis and a ``mess'' left by former Federal Reserve Chairman Alan Greenspan.

...while the global economy accelerates ...Soybeans, Corn Futures Advance as Inflation Concerns Spur Commodity Buying Soybeans rose to a 19-year high, heading for their sixth weekly gain, on speculation investors may boost holdings of commodities to hedge against inflation.

Crude Oil Advances After Venezuela Minister Rejects OPEC Output Increase Crude oil rose after

But some simple analysis will show you that inflation is there, just invisible to the BLS. And the longer they ignore it, the bigger the bull market will be in gold and silver.

Let’s lift the hood a bit.

The October level was 3.5% higher than the year-earlier period. In fact, unadjusted year-over-year inflation clocked just 2% in August, then 2.8% in September, and now 3.5% in October. If this same rate of acceleration continues, headline unadjusted CPI should be over 4% year-over-year in November. And there’s every indication that CPI will continue to accelerate.

Why? Well, the BLS says consumer energy prices rose just 1.4% in October. Looking at that number, you have to wonder what country they’re talking about. Energy prices went up more than that. How could they be so wrong from what our eyes tell us?

We’ll have to look at yesterday’s PPI Index for a clue. The PPI showed that gasoline prices fell 3.1% in October, and energy prices fell 0.8% overall. That’s simply not based in reality. Instead, it’s a quirk of how the BLS collects its PPI data.

The BLS methodology for measuring PPI is flawed: It measures prices on a single day of the month. BLS samples for energy prices on the Tuesday of the week that contains the 13th of the month. In other words, BLS’ methodology essentially ignores all energy prices paid except for one day of the month.

Energy prices roared higher late in October, but the BLS missed that. These prices are already passed along and should be incorporated into November's CPI.

The BLS page explaining how it measures price changes for motor fuels in the CPI doesn’t explain how many days it incorporates into the sample. However, considering its flawed methodology for the PPI, the CPI collection data methodology should be suspect until proven otherwise.

This lays the groundwork for rising energy prices to arrive in the CPI in one huge rush. Likewise, food prices, which officially only clocked a 0.3% rise in October, could also be in for a sudden surge. I think December could be shocking indeed. Brace for impact – higher prices are on the way.

More importantly, the CPI data was “tame” enough that it clears the way for the Federal Reserve to lower interest rates again. That should send an already wounded US dollar even lower. Since gold, silver and other commodities are priced in dollars, as the dollar goes down, they go higher. And that should supercharge commodities that are already on a rocket ride.

Labels: US economy

Jim Rogers Urges Investors to Sell U.S. Dollar Holdings as Currency Slumps Investor Jim Rogers urged people to get out of the dollar and says he expects to be rid of all his

China's Industrial Output Growth Sparks Concern Economy May Be Overheating

Indonesia's Economy Expands 6.5 Percent, Fastest Pace Since 1997 Crisis Indonesia's economy expanded 6.5 percent in the third quarter, the fastest pace since the 1997 Asian financial crisis, spurred by bumper harvests and rising sales of cars, motorcycles and homes.

World Bank Raises East Asia's Economic-Growth Forecast as China Expands East Asia's economies will expand at the fastest pace in more than a decade in 2007 as

Rupee Gains a Second Day as India's Growth May Keep Luring Overseas Funds India's rupee rose for a second day on speculation economic growth that is the fastest among major economies after China will keep drawing overseas investment.

U.A.E. Considering Ending Dollar Peg for Currency Basket, Suwaidi Says The

Murdoch Intends to Drop WSJ.com Fee "Rupert Murdoch, the chairman of the News Corporation, said today that he intended to make access to The Wall Street Journal’s Web site free, trading subscription fees for anticipated ad revenue.

Hunan Nonferrous Metals Corp, China`s biggest zinc and tungsten producer, may spend as much as US$673 million next year buying stakes in mining companies and mines in Australia and Canada

Labels: China, commodity supercycle, India, US dollar

The Producer Price Index clocked a 0.1% rise in October, which was less than expectations of 0.3%. However …

There was something funky with the gasoline number. Gasoline prices fell 3.1%, which must have been a quirk of when the data was collected – that is, it must have missed the big rise that started at the end of October. I can tell you that gasoline prices are certainly rising now.

And the year-over-year rise in headline PPI was 6.1%, versus 4.4% in September. That means the annualized pace of PPI growth has hit a 2 year high! Look at this chart I’ve made of the year-over-year rise in the headline producer price index. That sure looks inflationary to me.

Producer prices ex- food and energy (the core number) looks tame, but looking at prices without food and energy doesn’t work for me. Show me someone who lives without consuming food or energy.

Still, the stock market futures are reacting very postively to this number, because traders this PPI number gives the Fed more room to cut interest rates in December.

If the Fed follows the market’s wishes (the probability of a quarter point rate cut next month is 80%), that means more downward pressure on the US dollar. And THAT should mean more upward pressure on gold and silver.

Labels: agriculture, ethanol, MoneyandMarkets.com

Labels: US dollar

Labels: gold

Labels: US economy

Labels: agriculture, oil, Treasuries, US economy

I think we're in for a pullback. I added an ETF to Red-Hot Canadian Small-Caps today that aims to track 200% of the INVERSE of the Russell 2000 Index. We'll see how it does.

I think we're in for a pullback. I added an ETF to Red-Hot Canadian Small-Caps today that aims to track 200% of the INVERSE of the Russell 2000 Index. We'll see how it does.

Here are some news stories/opinion pieces that worry me …

CDOs: The Ticking Time Bomb The equity markets seem to have finally realized that conditions are ugly in the credit markets, due to get uglier, and the mess will pull down the real economy. And the bad news continues. The dollar index fell to a new low. Wachovia said the value of its subprime securities, largely "super senior" tranches of CDOs, fell $1.1 billion and it was witnessing sharp falls in housing prices in some areas of the US.

We had questioned the optimistic assumption of a few weeks ago, that investment banks were taking deep enough writedowns to put their woes behind them. How can you possibly do that unless a market is at or near bottom? Wall Street analysts have indicated that they expect further writeoffs at the Wall Street firms.

Oil Price Rise Causes Global Shift in Wealth

Iran, Russia and Venezuela Feel the Benefits High oil prices are fueling one of the biggest transfers of wealth in history. Oil consumers are paying $4 billion to $5 billion more for crude oil every day than they did just five years ago, pumping more than $2 trillion into the coffers of oil companies and oil-producing nations this year alone.

Barclays bankrolls Mugabe's brutal regime BARCLAYS is bankrolling President Robert Mugabe's corrupt regime in Zimbabwe by providing substantial loans to cronies given land seized from white farmers.

The Worst Economy of Our Lifetime, pt III

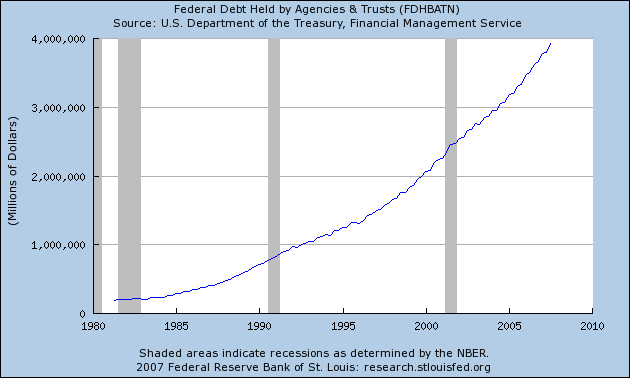

The Republicans are spending social security money now, hoping no one will notice. And so far they're getting away with it. But intra-governmental debt is still debt. It has a legal priority claim on government revenue and must eventually be paid.

Scientists say get ready for a hotter planet

"There is medium confidence that approximately 20-30 per cent of species assessed so far are likely to be at increasing risk of extinction if increases in global average warming exceed 1.5-2.5 degrees Celsius." Warming of at least two degrees is considered a near certainly this century based on IPCC climate models.

And here's a story about the Arizona housing bubble that makes the South Florida housing bubble look like a walk in the park.

Labels: US economy

My wife and I drove down for the Miami Book Fest. It was great -- I got to talk to Paul Krugman (well, ask him a question), listen to Wesley Clark, Dave Barry, and a bunch of other authors.

My wife and I drove down for the Miami Book Fest. It was great -- I got to talk to Paul Krugman (well, ask him a question), listen to Wesley Clark, Dave Barry, and a bunch of other authors.

And another thing on the September trade deficit -- it came in at –56.45 billion, down from August’s revised number of –56.85 bln. The August number was revised from –57.6 bln. Analysts were expecting the September reading to come in at –58.5.

So, it's party time, right? Not so fast. The big deficit that worries us is the deficit with China. But the deficit with China actually grew to –23.77 billion from –22.53 billion. With China accounting for such a large percentage of the trade deficit and it rising, as my friend and commodities broker Charlie Nedoss says, "it is like putting lipstick on a pig to say that this is a positive number."

We are seeing a weekly sell signal on the SPY. If it closes at these levels, that will be very bearish.

We are seeing a weekly sell signal on the SPY. If it closes at these levels, that will be very bearish.