Australia as the Power Player for the 21st Century

http://www.smh.com.au/news/opinion/a-thirsty-world-is-running-dry/2006/07/30/1154198009168.html

"Luck is not chance, it’s toil; fortune’s expensive smile is earned.”

And my favorite...

"Coffee May Rise as Indians, Mexicans and Indonesians Urged to Drink More"

Apparently, the International Coffee Organization has greased the right palms and the governments of those countries will promote coffee-drinking among their populations. Well, there's nothing in the official story about greasing palms. But really, why the heck else would they? Maybe the ICO is staffed by the most charismatic, over-caffeinated folks you ever met! LOL!

Meanwhile, many Australian stocks got shellacked overnight, but not the uranium stocks -- three of which are in the Red-Hot Asian Tiger Portfolio.

And Red-Hot Canadian Small-Cap subscribers should look for good news on a certain SAGD oil sands company -- its stock is moving higher for a reason.

July 11 (Bloomberg) -- Crude oil rose the first day in four after Iran's president said his nation won't back down "one iota'" on its right to conduct atomic research, the day his top negotiator held talks aimed at resolving the nuclear dispute.

Iraq expects its daily oil production to reach 6.0 barrels per day by 2012 and be challenging Saudi Arabia as the world's largest producer by 2015, Iraq's Oil Minister Hussein Shahristani said last month.This from a country that produces -- at BEST -- 3.5 million barrels a day before the FIRST Gulf War. Iraq produces at most 2.4 million barrels per day now, and its oil infrastructure is coming apart at the seams due to constant bombings and other sabotage

Stampede, a kick-ass rodeo that runs from July 7 through the 16. There are chuckwagon races, a "winner-take-all" $50,000 rodeo, a midway, and more. The Stampede has been an annual event since 1912. I do have an image of the 1912 poster, but the 1913 poster is much cooler, IMO. You can see them all for yourself by clicking HERE.

Stampede, a kick-ass rodeo that runs from July 7 through the 16. There are chuckwagon races, a "winner-take-all" $50,000 rodeo, a midway, and more. The Stampede has been an annual event since 1912. I do have an image of the 1912 poster, but the 1913 poster is much cooler, IMO. You can see them all for yourself by clicking HERE.Point is, if you need to talk to someone in Calgary this weekend, they might be a tad busy.

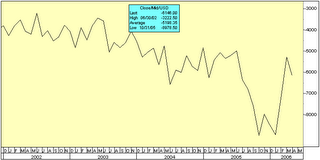

Late last year, the US balance of trade with Canada went into free-fall -- American consumers started buying a lot more stuff from Canada than Canada bought from th US. But earlier this year, things really started to turn around.

Late last year, the US balance of trade with Canada went into free-fall -- American consumers started buying a lot more stuff from Canada than Canada bought from th US. But earlier this year, things really started to turn around.

Canadian Prime Minister Stephen Harper, naturally, would like to see that line turn down again, and Canadian exports to the US go up. Today, Harper said his good friend President Bush can count on a secure flow of oil and gas from Canada, its biggest energy supplier.

Harper emphasized the two countries' special relationship as the US Congress tightens the screws on travel across the border. Starting Jan. 1, 2008, a passport or equivalent identification is required for all people traveling to the U.S. from countries where passports hadn't been previously required, such as Mexico, Canada and parts of the Caribbean. That goes for US citizens, too.

Harper is hoping to get the US to reconsider that rule, since $1.5 billion a day worth of goods and services crosses the border between the US and Canada, and the balance, as you can see from the chart above, is definitely in Canada's favor. To further entice Bush to see things his way, Harper is arm-twisting Canada's lumber industry into agreeing to a settlement on a softwood dispute that has dragged on since 1982.

But several provincial governments and their lumber associations have complained about the agreement. According to Trevor Wakelin, chairman of the Alberta Softwood Lumber Trade Council, the agreement "is not a long-term deal, it does not provide operating certainty, and in its current form is unacceptable to most Alberta producers."

To be fair, some US lumber producers are complaining as well, but that might just be to give Harper some political cover.

And Harper should learn a lesson from Tony Blair: Bush doesn't reward loyalty in international affairs. He just expects it from others.

You can read the Bloomberg story by clicking HERE.

Sounds like a lot of tough choices for Harper.

"This $1 billion company produces varieties of cotton for sale in the U.S. and other countries. It's bringing 10 new varieties of cotton seed to market. It trades at about 20 times projected earnings (cheap), and its chart shows a breakout after a long consolidation. Our initial price target is 47 -- a 56% move higher from recent prices."

"Delta & Pine Land Co., the biggest U.S. cottonseed producer, said third-quarter earnings rose 31 percent after farmers planted more acres with cotton and bought more seed modified to resist bugs and weeds. The shares surged as much as 9.8 percent as profit topped analysts' estimates."And here's a chart...

Chart #2: Silver. Nice breakout!

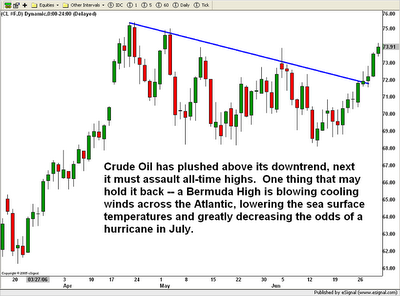

Chart #2: Silver. Nice breakout! Chart #3: Crude Oil

Chart #3: Crude Oil